Investing doesn’t require lakhs. Sometimes, ₹1000 per month is enough to begin your wealth journey — if you choose wisely.

If you’re searching for the best SIP plans for 1000 per month, chances are you want:

- Low risk

- Good long-term returns

- Simple starting process

- No complicated jargon

Let’s break it down in a practical, beginner-friendly way — without unrealistic promises.

What Is a SIP?

A Systematic Investment Plan (SIP) is a method of investing a fixed amount regularly (monthly or quarterly) into mutual funds. Instead of timing the market, you invest consistently, benefiting from rupee cost averaging and long-term compounding.

Can ₹1000 Per Month Really Build Wealth?

Short answer: Yes — but with time and discipline.

If you invest ₹1000 monthly for:

- 10 years at 12% average return → approx ₹2.3 lakhs

- 20 years at 12% → approx ₹9.9 lakhs

- 25 years at 12% → approx ₹17 lakhs

The magic here is compounding.

But remember — returns are market-linked, not guaranteed.

Who Should Invest ₹1000 in SIP?

This amount is ideal for:

- College students

- First-time investors

- Salaried beginners

- Homemakers starting financial independence

- Anyone testing mutual fund investing

Starting small builds discipline.

Types of Mutual Funds Suitable for ₹1000 SIP

Before selecting the best SIP plans for 1000 per month, understand categories.

1. Large Cap Funds (Low to Moderate Risk)

- Invest in top 100 companies

- More stable than small caps

- Suitable for beginners

Good for long-term steady growth.

2. Index Funds (Low Cost Option)

- Track indices like NIFTY 50 or Sensex

- Lower expense ratio

- Transparent strategy

Best for passive investors.

3. Flexi Cap Funds

- Invest across large, mid, small caps

- Managed actively

- Slightly higher risk

Suitable if you want balanced growth.

4. ELSS Funds (Tax Saving)

- Eligible under Section 80C

- 3-year lock-in

- Equity exposure

Good if tax saving is your goal.

Best SIP Plans for 1000 Per Month in 2026 (Category-Wise)

Below are well-known funds (not recommendations, but examples based on consistency, AUM stability, and track record).

Large Cap Funds

- SBI Bluechip Fund

- HDFC Top 100 Fund

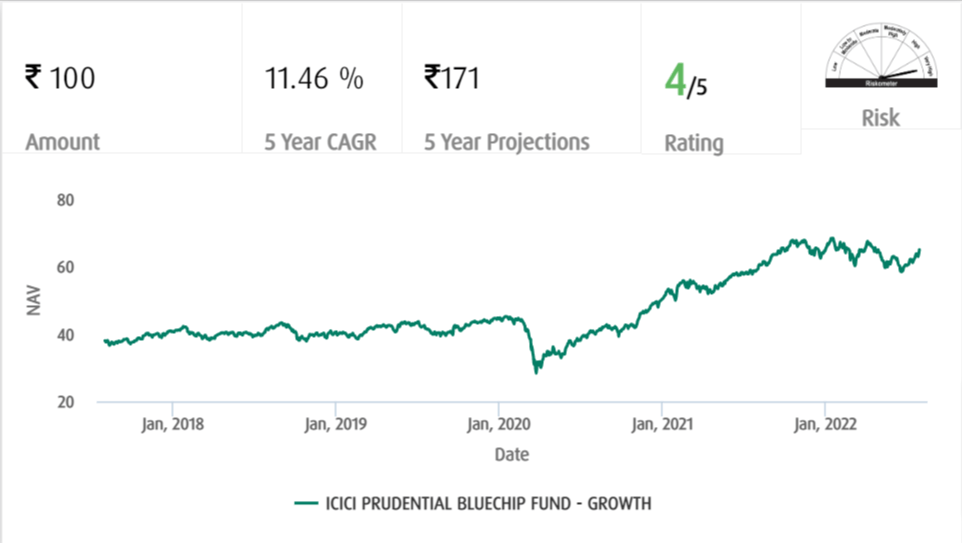

- ICICI Prudential Bluechip Fund

Why consider: Stable, suitable for first-time SIP investors.

Index Funds (Low Expense)

- UTI Nifty Index Fund

- HDFC Index Sensex Fund

Why consider: Lower expense ratio = better long-term compounding.

Flexi Cap Funds

- Parag Parikh Flexi Cap Fund

- Kotak Flexicap Fund

Why consider: Diversification across market caps.

How to Choose the Best SIP Plan for ₹1000

Don’t blindly chase “highest returns”.

Step 1: Define Your Goal

- 5 years → Hybrid or large cap

- 10+ years → Equity/index funds

- Tax saving → ELSS

Step 2: Check These 5 Factors

- Expense ratio

- Fund manager track record

- 5–10 year consistency

- Risk ratio (Standard deviation, Sharpe ratio)

- AUM stability

Step 3: Choose Direct Plan Over Regular

Direct plans have lower commission.

Over 20 years, this difference matters.

SIP vs Recurring Deposit (RD) for ₹1000

| Feature | SIP | RD |

|---|---|---|

| Returns | Market linked | Fixed |

| Risk | Moderate | Very Low |

| Inflation Protection | Yes | No |

| Liquidity | High (except ELSS) | Moderate |

If your goal is wealth creation → SIP.

If safety only → RD.

Realistic Return Expectations

Equity mutual funds historically delivered around 10–14% over long term.

But:

- Short term (1–2 years) → volatile

- 5+ years → smoother returns

- 10+ years → compounding visible

Never expect guaranteed double returns quickly.

Pros & Cons of Investing ₹1000 Monthly

Pros

- Affordable

- Builds investing habit

- Power of compounding

- Flexible withdrawal

Cons

- Small amount = slower corpus

- Market volatility risk

- Emotional panic selling

Common Mistakes to Avoid

- Stopping SIP during market crash

- Choosing based on last year return

- Ignoring expense ratio

- Investing without goal

Consistency beats timing.

How to Start SIP with ₹1000

- Complete KYC online

- Choose mutual fund platform

- Select fund category

- Start SIP mandate

- Review annually

That’s it.

Expert Insight

From experience working with beginner investors:

Most people delay investing because they think ₹1000 is too small.

But disciplined small investments often outperform irregular large ones.

The real advantage is:

- Behavioral discipline

- Market participation

- Time in market

Even professional advisors recommend starting early rather than waiting.

FAQs

1. Is ₹1000 enough to start SIP?

Yes. Many mutual funds allow SIP starting from ₹500 or ₹1000.

2. Which is the safest SIP for ₹1000?

Large cap or index funds are relatively stable compared to small caps.

3. Can I withdraw SIP anytime?

Yes, except ELSS funds (3-year lock-in).

4. What return can I expect from ₹1000 SIP?

Over long term, 10–12% annual average is realistic historically, but not guaranteed.

5. Should I increase SIP later?

Absolutely. Increasing SIP with salary growth accelerates wealth creation.

6. Is direct plan better for ₹1000 SIP?

Yes, because lower expense ratio improves long-term returns.

Conclusion

The best SIP plans for 1000 per month are not about chasing highest returns.

They’re about:

- Starting early

- Staying consistent

- Choosing low-cost, diversified funds

- Reviewing annually

₹1000 may look small today.

In 10–20 years, it can become meaningful wealth.

Start small. Stay patient. Let compounding work.

Disclaimer

Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing. Returns mentioned are historical averages and not guaranteed.